Single mothering is a rewarding experience, though it is also associated with financial insecurity. A single mother who has to bring up children on her own makes it even more difficult to balance income and expenses, savings, and emergencies.

However, with smart budget tips for single moms and commitment, you may develop financial strength without losing stability or quality of life. Here, I share 10 practical, proven strategies to help you create a solid budget for single mom and thrive financially in 2026.

Let’s dive in and find out how you can become financially stable through budget for single mom even with the pressure of motherhood!

Why is Budgeting for Single Moms Important?

Budgeting for moms is not an option, but a necessity in an era of increased prices and economic insecurity. An effective budget for single mom can make you:

- Securing your family against unexpected economic shocks.

- Living on your means to avoid debt traps.

- Creating a personal savings cushion.

- Guaranteeing your children’s needs are fulfilled without the need to strain your finances.

- Learning to control your money instead of letting your money control your life.

- Encouraging emotional and mental relaxation through a lack of financial stress and a sense of security towards yourself and your children.

10 Proven Ways to Create a Budget for Single Mom

1. Understand Your Current Financial Picture

The first and most essential step in financial planning for single mothers is to understand what’s coming in and what’s going out. This helps you design a budget for single mom that really works for you. To start, understand your income and expenses in full detail:

- List all income sources like salary, child support, benefits, or side jobs.

- Track all monthly fixed expenses such as rent, utilities, school fees, transportation, and childcare. Also include variable costs such as groceries, clothing, and fun activities.

- Limit variable income: When income changes monthly, plan on the lowest plausible amount and make changes when you earn more.

A monthly budget for single mom worksheet or single mom budget template can help you organize this clearly. It doesn’t need to be fancy. A simple budget sheet for single mom or even a notebook works fine as long as it shows what money is available after essentials are paid.

2. Use a Simple Budgeting Method: Zero-Based or 50/30/20

Choose a simple method for your budget for single mom to make it effective. Two popular approaches help single moms handle money with ease. They can easily be included in the budget plans for single moms.

1. Zero-Based Budgeting

In this method, each rupee (or dollar) will have its purpose: to spend, to save, to pay the debts, or to give. By month-end, your income minus expenses will be zero, and you will be spending every cent wisely.

2. 50/30/20 Rule

If you prefer a simpler approach to your single mom personal finance:

- Divide 50% into necessities like shelter, food, and child care.

- Use 30% on wants like entertainment or little family delicacies.

- Save 20% for goals, debt, or emergency funds each time.

Feel free to adjust these percentages to suit your needs to have the best budget for single mom and be able to save up slowly but progressively, changing them to more of what you need in the process.

3. Prioritise Essentials: Your “Four Walls.”

When dealing with a single income, it is important to ensure that basic needs are met before money is spent on other things. According to experts, these are called the four walls of financial stability, which comprise:

- Shelter (rent/mortgage)

- Food

- Utilities (electricity, gas, internet)

- Transportation (car, fuel, bus fare)

When these necessities are well covered, you can invest the money into other important needs such as childcare and school fees. Then you can save or indulge in minor wants without compromise to financial security. This is a disciplined approach to budget ideas for single moms that eliminates financial-related stress and extravagance.

4. Save Consistently and Build an Emergency Fund

Life is unpredictable. Medical bills, repairs, and unexpected expenses can come at any moment. This is why an emergency fund is one of the major pieces of financial advice for single moms to include in their single mom budget.

Intended to save 3-6 months of key costs. Have automatic bill pay from your checking account to a savings account on every payday. Begin with a little, maybe 50 or 100 a month, and increase with your income. Also, open a high-interest savings account to maximise your savings.

Having this fund provides peace of mind and ensures you’re prepared for surprises without derailing your regular budget planner for single mom.

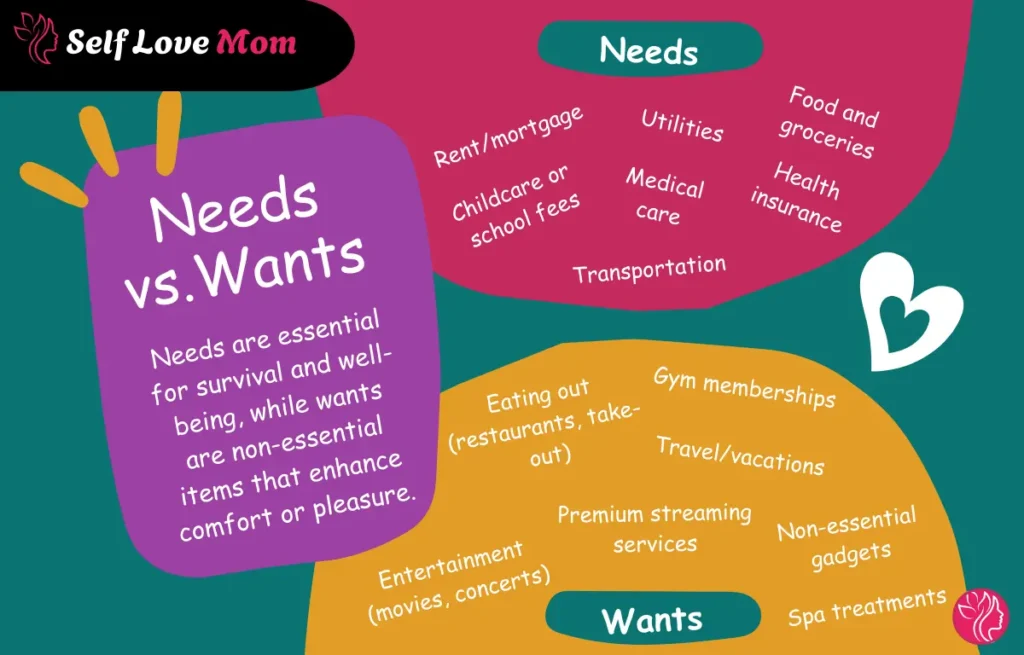

5. Trim Unnecessary Costs and Reassess Needs vs. Wants

Surviving on a single income may be a very tough choice. The most significant advice on how to survive financially as a single mom and save is to review your expenses and minimise unnecessary spending. Saving money as a single mom requires smart strategies.

Here’s how to save money as a single mom

- Cook: Do not visit take-outs or restaurant meals.

- Shop smart: Shop with coupons, shop in bulk, and shop generic.

- Review your plans: Find cheaper cell phone plans and other transportation.

- Cut back on luxury: Cut back on spa treatments, fancy coffee, and unnecessary shopping.

- Utilise benefits: Use financial assistance such as SNAP, child tax credits, and local aid.

With these money-saving tips for single moms, you will be able to build your financial base and save money in the long term.

6. Avoid High‑Interest Debt and Use Credit Carefully

Debt is a trap, particularly for in budget for single mom. Using credit cards or loans to meet monthly bills may be an easy solution, but debts with high interest rates can escalate into huge proportions.

Here are some of the smart ideas for managing debt:

- Use credit in case of an emergency: Do not use it for day-to-day expenditures.

- Prioritise debt repayment: make debt payments a fixed cost in your budget.

- Pay off balances each month: In case you are in credit card debt, you should strive to clear the debt by the end of the month to prevent interest. Otherwise, think of low-interest options.

- Track your spending carefully: A proper budget or budgeting application will help ensure that you do not spend excessively.

Using debt wisely will help you not to earn more than you spend and save your single mom personal finance.

7. Look for Ways to Increase Income

At times, the budgeting itself might not suffice to meet the ends. In such situations, knowing how to make more money as a single mom can be a game-changer. Think about finding a way to boost your earnings by having side hustles or other options that are in line with your interests and skills.

Here are some ideas on how to make money as a single mom:

- Freelancing: Consider online freelance work in writing, design, tutoring, or consulting.

- Part-time jobs: Look for flexible, part-time jobs that fit into your schedule.

- Start a side hustle: If you have a hobby or skill, such as crafting or photography, consider turning it into a small business.

You can find these helpful:

- 18 Best Jobs for Single Moms: High-Paying, Remote & Flexible Work

- 17 Best Careers for Single Moms in 2025 – Flexible & Well-Paid

- High Paying Jobs for Single Moms: 15 Best Remote Jobs in 2025

With these opportunities, you can make more money as a single mom without compromising time with your children. No matter how many hours a week you are willing to work or make it a full-time job, these side hustles would make you feel more financially confident and help in budget for single mom.

8. Choose the Right Budgeting Tools

Financial management does not always have to be done on a pen and paper basis. Many affordable, user-friendly low-end budgeting software options may help single moms track expenses, build savings, and stay within their monthly budgets.

Some of the best budgeting apps for single moms include:

- You Need a Budget (YNAB): A highly rated and best budget app for single moms based on zero-budgeting: each dollar gets a job. Ideal for practical budgeters who want control over each rupee or dollar.

- Goodbudget: This is based on an envelope (virtual envelopes) approach to spending your budget (rent, groceries, savings, etc.). Helps avoid wasting money on one thing.

- PocketGuard is a simple dashboard that shows how much “free money” you have left after bills and necessities, useful when every rupee counts.

- Quicken Simplifi: You can connect all accounts, see what bills you are about to pay, and predict what you will spend in the future. Handy when you need to automate and forecast instead of typing.

Moreover, having a budget planner for single mom on your phone helps you to stay organised, especially when life is busy. Add that equipment to regular check-ins (once per week or once a month), and it will be far easier to follow the money management for single moms

9. Plan for the Future

Budgeting as a single mom is not only about living day to day but also about establishing a stress-free and secure future. Being a single mother, it is necessary to set a couple of short-term and long-term financial goals:

- Development of an emergency fund: To meet unforeseen expenditures.

- Clearing debt: To clear the way to other objectives.

- Savings towards educating your children: To give them a better future.

- Investing for retirement: Small daily deposits will make a difference.

- Assuring financial security in the long run: To you and your children.

With clear objectives and by clearing them, you are not only creating your future but also giving your family a solid base.

10. Adapt and Review Regularly

Life is evolving, children grow, costs vary, and incomes vary. That is why the budget plans for single moms should be flexible and adaptable. Develop time on a monthly or quarterly basis to:

- Balance your budget: Adjust income, cost, savings, and objectives.

- Analyse what is required and what can be done better.

- Adjust accordingly and redistribute funds.

When you frequently revisit your budgeting tips for single moms, you can adjust to budget changes and keep working toward fulfilling your financial aspirations.

Sample Monthly Budget Template for Single Mom

Here’s a simple single mom budget template you can use as a starting point (adjust numbers according to your income and local costs):

| Category | Budgeted Amount |

| Rent/Mortgage / Housing | 30–40% of income |

| Utilities (electricity, water, internet) + Bills | 5–10% |

| Food / Groceries | 10–15% |

| Childcare / Education / Kids’ needs | 10–15% |

| Transportation / Fuel / Travel | 5–10% |

| Savings / Emergency Fund | 5–15% |

| Misc / Clothing / Unexpected | 5–10% |

| Discretionary (small treats, entertainment) | as budget allows |

You can create this sample budget for single mom template in a spreadsheet, one of the budgeting applications mentioned above, or on a piece of paper. Alternatively, download your free Single Mom Monthly Budget Planner(PDF) to start tracking your finances today.

Common Challenges and How to Handle Them

Things may be hard even with the best budget for single mom. Some of the pitfalls and how they can be avoided are as follows for mom on a budget:

- Irregular income: Single mothers mostly have either freelance or part-time employment, which is not consistent. Solution: When budgeting, use a low ground-level income (i.e., the average of the last 6 months) and assume the rest as more (i.e., a bonus). Invest either in savings or debt repayment.

- Unexpected expenses (medical, school, emergencies): That is why an emergency fund is required in the budget for single mom. Even a small amount of monthly savings will be compensated in the long run and give a safety net.

- Feeling deprived or guilty about budgeting: Budget for single mom does not need to be a matter of deprivation. It’s about control. Use little allowances to have fun, treat days, or family outings- but within a limit. A budget for single mom will help you make decisions about what to spend on.

- Emotional spending or peer pressure: It is easy to spend more, mainly in social places. A clear budget plan for single moms and adhering to it will help you say no to spending time and money in other areas that do not match your priorities.

Final Thoughts on Budget for Single Mom

Managing everything on one income is not easy. But with a solid budget for single mom, the right mindset, realistic financial tips for single mothers, and a helpful app, you can build financial strength.

Keep in mind: single mom budget is not a constraint. It’s a plan. A strategy that assists you in satisfying your demands, providing a future for your family, and even the opportunity to develop.

Stick to effective money tips for single moms, stay consistent, adjust when you need to and over time you’ll see the difference.